The three boxes to tick for the perfect case

I have earlier written a post about where the total return comes from in a case and condenses it down to EPS growth + P/E valuation + Dividend. Here is the earlier post Vad ger (total)avkastning? (in Swedish)

So if we taking this in consideration what is the perfect case when looking at a company?

Increasing Net Sales

Increasing Margins

Low valuation

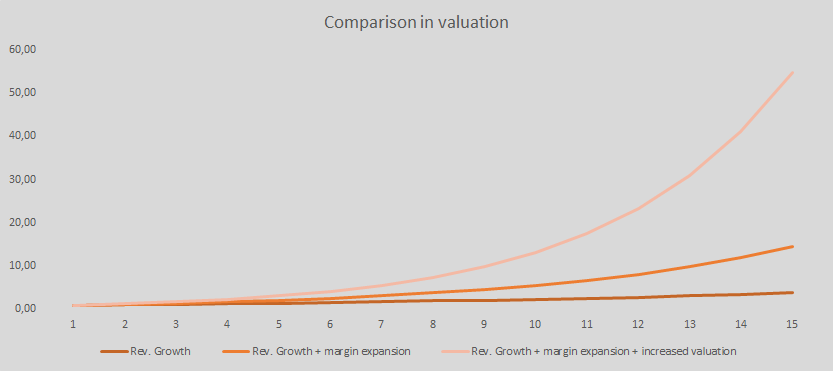

To illustrate this, I have made this below exemple with three different scenarios.

Scenario 1: Revenue grow by 10% per year.

Scenario 2: Revenue grow by 10% per year and profit margin grows 10% per year.

Scenario 3: Revenue grow by 10% per year, profit margin grows 10% per year, and 10% increase in valuation.

As illustrated the trifecta effect is very powerful and over a period of time will create immensly value for their investor.

Essentially these are the metrics we as investors look at to earn a return on investments. The two before are mostly internally driven with some external components, while the low valuation is almost exclusively an external factor.

Let's look into these three different and what an investor should look after to estimate higher net sales and higher margins and conclude the valuation is low.

Increasing Net Sales

There are many ways to increase net sales, either through good internal investments in assets or by externally acquiring assets through acquisitions. Historically, the acquired growth has not yielded any high valuations. Still, recent times have changed (at least on the Swedish stock market, and a company that just promises to acquire can earn a premium for the anticipated acquisition). But they both boil down to return on invested capital (ROIC) and reinvestment rate, here can we discuss in ages dividend is a good thing? Doesn't that signal that the company has limited projects to invest in to earn a return on capital? Or does it signal that the company is overcapitalized and it is better to let the investors invest it somewhere else? So, in the end, is management good at capital allocation to earn a high ROIC?

One aspect we don't have mentioned yet is the market the company is operating on and have options to evolve into. Are they active on a market that grows signifacntly and gives the assets the company possess optionality to evolve in other markets? With a market that grows and a management that don't compeletly fail to allocate the capital will the company with most certain probablity have higher Net Sales in the future. Adding on optionality in their business will also the runway for increased Net Sales be longer than many anticipates.

Increasing Margins

The cause of increasing margins differs from what stage the company is at the moment. So the cause can be several things. From a company reaching the infliction point of scalability in their business, a change in their a companies business model, the product and service mix change, changes in the market goes towards a higher-margin way of distributing their products, price increases without any loss of customers, the price of important inputs decreases, and many other reasons that are mostly internal but also can be of external reasons.

To group it, I would say it is two internal causes and one external cause. The two internal causes can be divided into a one time change, and the other is of continuous nature but can be mixed as the one time change is not by a snap of a finger but happens over a long period of time. I would label the one of continuous nature as "Moats" and the other I would label as "operational development" I hope you see the distinction between the two.

The external cause is problematic as you need to evaluate if the cause is sustainable and will continue, or it will reverse and negatively affect it.

Let's take an example to illustrate this better. In gaming, we have had a conversion from CDs to downloading the games digitally. This is an example of a sustainable cause and will continue as it is a better experience for most gaming consumers. It is faster, and you can't lose your game, but the most negative side is that you can't lend it out to a friend or resell it. Both negative is positive effects for gaming companies. Meanwhile, the decrease of an input good such as oil volatile in price will most probably be net positive during one period and net negative during another period.

Low Valuations

Let's start of asking what is low valuation?

If we skip the TINA discussion and focus on what has happened in recent years with digital businesses compared to traditional analog ones. Everything from the product to the distribution and now integration is digital. This means the COGS are much lower as the second creation of the software is no additional cost, and distribution is also low as the logistics costs are essentially zero for software.

In a way, you can argue COGS has moved to Research and Development and/or Depreciation and Amortization of in-house developed assets. It is the product that is sold to customers but is not consumable as a physical product. So the service will be used again and again. This is shown very clearly by the Visual Capitalist post, which I recommend reading.

This leaves the OPEX costs for admin, marketing, sales, and other operating costs. These are not so different from industry to industry; everybody needs a marketing department, finance, sales, and general costs. Could even argue that there is a need for fewer finance departments and general costs with no factories producing anything.

Taking a look below we can see a difference between the traditional sectors and the IT sector in the average margins. Which is quite telling as the IT sector is younger and more immature, hence would entail lower margins.

IndustryGross margin (%)EBITDA margin (%)EBIT margin (%)Profit margin (%)Industry, miscellaneous, material, energy36%14%6%3%IT48%17%10%8%

Let's also look at the growth side. To reach 50 million users has never been done faster and it´s going even faster. Another great visualization from Visual Capitalist.

If we take this in consideration wouldn't make sense to have digital companies focus on growing their userbase and not being profitable for a few years?

Especially since the competition also can grow as fast, the only option is to grow as fast as you can to establish a userbase that they can turn profitable later on. Given the high gross margin of digital companies, it can also be assumed the profit margins will be pretty high.

Also, given that most digital companies are building strong network effects and switching costs, it can be assumed that most of the users will stay for a long time. With software going from on-premise deployment to the cloud on a SaaS model, the revenue will be recurring and easily managed remotely to update the whole customer base.

Because of this, wouldn't a high P/S valuation be valid?

It may sound a little like the arguments as in the 99's, but compared to those companies, at least companies today have revenues and are not valued on the number of eyeballs.

This arguing for high valuations is not that high after all when this is a post of finding the three boxes to tic for a perfect case where low valuation is one of these tic boxes. But I want to argue you would miss many cases if you just look at a P/E valuation and say it is high, given the new possibilities digital products and services give companies unprecedented scalability and to reach more customers than ever before.

But let's talk low valuations instead of high ones. A low valuation can be due to being an undiscovered company, a shunned business by investors, lack of trust in the management, unfavorable market outlook, and many other reasons. The low valuations connect back to the two other tic boxes; you must have a different view than consensus to see any upside in the valuation. If the reason doesn't connect with the two earlier boxes, the market may shun the sector, such as with gaming companies where the valuations are low or companies under a certain market valuation. You can have an edge by not having to abide by ESG restrictions or other reasons for the broader institutions not to invest in the asset.

Another way to find low valuations is to look at companies doing their financial reporting according to GAAP in a specific country compared to IFRS. Especially in Sweden, there is a difference in handling depreciation on intangibles; in the acquisition, active companies do this to create visually low earnings; meanwhile, the cash flow is strong. I have taken up just this case in two companies in my former podcast Game of Stocks, Awardit and Embracer Group, how these companies' valuation was looking shockingly high but, as a matter of fact, was low. All because of accounting differences between Swedish GAAP and IFRS, causing the depreciation is much higher than peers.

Valuation differs from the other two variables as it reflects the expectations of the revenue growth and margins. Because of that, you can work both ways, from the valuation to the expected revenue and margin or from expected revenue and margin to the believed justified valuation. The same principle is made with DCFs, where you make one conventional DCF find the intrinsic value the asset is worth and a reverse DCF to see what the intrinsic value is expecting.

If there were anything to add, it would be a high ROIC as it would combine high margins with capital-light. You can argue that a high long-term ROIC is already taken care of by revenue growth and high margins, but it adds one variable of capital efficiency that the three other tic boxes don't handle. But this will only indirectly support a perfect case and are important for a case in the long run.

I believe a lot of you would argue that there are more areas to consider in a perfect case, and I agree, especially on the qualitative side. I wanted to condense as much as possible, and I will argue that everything else matters for a case, both qualitative and quantitative. It trickles down to either one or two or all three of the tic boxes mentioned above.

Investacus Saverajus