A you playing a winner's game or a loser's game?

In life we need to decide our battles, the same is with decidingwhat we should be good at (Winner's game) or not fail at (Loser's game).

In short to you play to win or do you play to not fuck up?

When investing you also need to choice between these two options, what should you choose?

Well it depends on your commitment to the game. Do you want to be aware of the investments you make every week and scan the market continously to make sure your investment is intact? Then you can play a winner's game, if you are not well than play a loser's game.

Now I understand nobody want to associate with a loser, but that is the opposite of the loser's game. You are trying to avoid being the loser while in a winner's game you trying to be the winner.

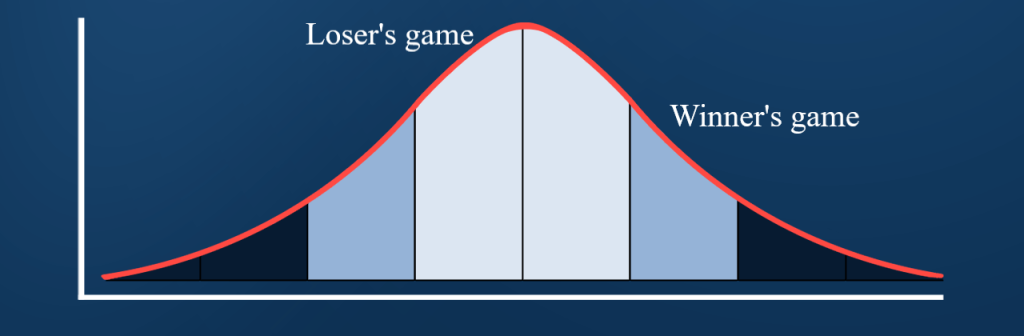

I am trying to illustrate here in a normal distribution of investor's perfomance where you want to place yourself.

If you are playing a winner's game you play to be in the top half of the top half if that makes sense. While you play a loser's game you play to be in the top half of the bottom half and being as close to the mean as possible.

What should you then do when you invest?

Well in a loser's game you should should invest in mutual funds and preferably cheap index funds.

If you decided to play a winner's game, you are in for a ride and a lot of work to do. It doesn't need to be complex, but it will not be easy. But aside for the hopefully higher return, you will have oceans of knowledge to dig down on which is for me the most intresting in investing.

Investacus Saverajus